Recently, I met two individuals who faced significant issues with their investment deals. While writing this blog, I acknowledge my own bias toward certain assets. Here are three incidents that illustrate the risks of certain investments:

# Incident 1: Fixed Return from Commodity Market

One of my clients invested with a private party for an 18% fixed return, following her sister’s example, who had been receiving such returns for the past 10 years. Unfortunately, both sisters ended up losing their capital. The sister who introduced my client initially invested 25 lakhs and eventually lost a total of 3 crores.

## Incident 2: Real Estate Investments

I met a gentleman who bought his dream home from builder ADHIRAJ in 2018 but is still awaiting possession. The complications include:

- The builder took an advance payment and, when asked for a refund, cited RERA policy to deny the refund.

- When the buyer approached his bank for a reset of the interest rate and EMI, as well as legal assistance against the builder, the bank refused. Ironically, the same bank would likely finance other projects by the same builder.

### Incident 3: Credit Risk: A Hidden Danger

In my hometown of Sirohi, there’s Adhar Co-op society that promised returns like those of equity investments. When I suggested to my family members that they invest in equity funds instead, highlighting that these funds would allow them to participate in India’s growth and invest in more transparent instruments, they were hesitant. I often told my relatives that if someone is offering higher interest rates, it carries a credit risk much greater than the risk associated with equity investments.

Unfortunately, one day Adhar Co-op Society defaulted, and now all its investors are waiting to recover their principal amounts. The total default exceeds ₹10,000 crores.

Moral: These incidents are not isolated. Many investors face similar issues, whether through promises of fixed returns, business partnerships, or discounted properties. Credit risk is an unseen and often unspoken danger, more perilous than equity risk. These stories often circulate on WhatsApp and Telegram groups offering fixed returns.

Why we Say “Mutual Fund Sahi Hai

Let’s assume a client bought a flat or invested in a commodity market on January 20, 2020 (just before the market crash due to COVID-19), when the Sensex was at 41,952. Today, the Sensex is at 78,053.52, showing a return of 20%.

Given that the market is at an all-time high, let’s consider few longer-term examples:

On January 8, 2008, the Sensex was at 20,873 (just before the market crash). As of June 4, 2024, the Sensex was at 70,000 (closing value on the election result date).

CAGR Return

- Absolute return: 235%, translating to approximately 14% CAGR.

- Average inflation: 7-8%, resulting in a real return of 7% (after accounting for inflation).

This example reflects only Sensex returns. Diversified equity funds have performed even better.

Instead of diversifying excessively and investing across various asset classes like Land/Real estate, Gold, Fixed Deposits, Startup ventures, etc. one should focus on a few assets that offer transparency, liquidity, capital protection and wealth creation.

Invest wisely and stick to reliable investment options like mutual funds, which offer:

- Easy liquidity and accessibility

- Affordability, even a small amount in SIPs consistency can grow significantly over time.

- Long term reliability, offering magic of compounding and rupee cost averaging

- Transparency of your asset holdings and non-bias valuations, e.g. an investor with Rs.1 Crore or Rs.1 thousand will be holding respective units against the same NAV declared.

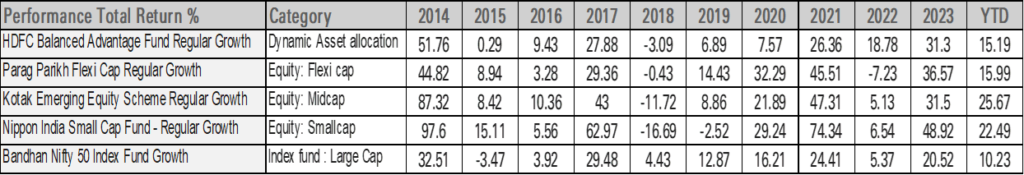

The performance of mutual funds can vary greatly depending on the specific fund, asset allocation, and market conditions, below are a few examples of performance over the period.

Make it Simple……

There is a mutual fund customized selection for every goal from person to person. While some cases of mutual fund mis-selling do occur, with proper guidance and professional support, one can attain significant wealth creation over the long term.

Fund performance chart data source: Morning star

Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purposes only and do not construe to be any investment or offer to sell/buy, legal or taxation advice. Please consult your Mutual Fund Distributor before investing. The views expressed are based on the current market scenario and the same is subject to change. There are no guaranteed or assured returns under any of the above-mentioned schemes / fund/ asset class.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.