ARE YOU A PART OF THE HERD TOO???

Behavioural finance is a field of study that examines the influence of psychology on financial decision-making. It challenges the traditional assumption that investors are rational actors who make decisions based on perfect information and logic. Instead, behavioural finance highlights how emotions, biases, and cognitive limitations can lead to financial mistakes.

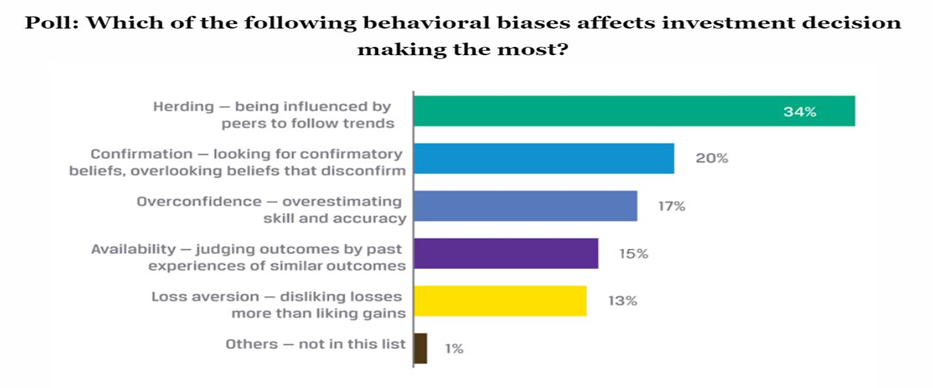

Some of the key concepts in behavioural finance are:

- Herd Mentality

- Loss Aversion

- Overconfidence

- Confirmation Bias and Availability Bias

- Framing

- Mental Accounting

In this blog we intend to make you aware if you are part of the crowd and how you can avoid it…

In behavioural finance, herd mentality bias refers to investors’ tendency to follow and copy what other investors are doing. Herd instinct at scale can create asset bubbles (e.g., stocks, property, cryptocurrencies bubbles) or market crashes via panic buying and panic selling. Herd instincts are common in all aspects of society, even within the financial sector, where investors follow what they perceive other investors are doing largely influenced by emotion and instinct, rather than relying on their own independent analysis.

Here, investors’ analytical and technical skills take a back seat, and their decisions are governed by emotions.It has a history of starting large, unfounded market rallies and sell-offs that are often based on a lack of fundamental support to justify either.

HERD MENTALITY IN FINANCIAL MARKETS

The fear of missing out (FOMO) on a profitable investment idea is often the driving force behind herd instinct but it can be a very big mistake.

One of the things to be very wary of is that we often find it emotionally or psychologically painful to go against the crowd. Think about a circumstance where you stifled your desire to do something because everyone else in your group voted to do something else. Psychologists have found that it may cause physical pain for people to be contrary investors.

It is almost always better to avoid the herd. After all, Warren Buffet can’t be wrong when he said, “Be fearful when others are greedy, and be greedy when others are fearful!”

Newbie investors are more prone to fall for herd mentality, as it is most likely that they have not tasted the negative effect of following the crowd.

Bubbles are the extreme example of herd behaviour. The investors will join the bubble which will eventually burst when market sentiment shifts. Many investors join mini herds and demand the latest hot stock or hot mutual fund. When prices break, other investors will join a herd of sellers. Obviously, herd buying or selling can be injurious to financial health.

The dotcom bubble of the late 1990s and early 2000s is a prime example of the effects of herd instinct. It was a rapid rise in U.S. technology stock equity valuations fuelled by investments in Internet-based companies during the bull market. Things started to change in 2000, and the bubble burst between 2001 and 2002 with equities entering a bear market resulting in 77% drop and loss of billions of dollars. Similarly, we have the bitcoin bubble which eventually burst in 2022. Real Estate bubble is also a prime example of the herd instincts.

Another example of herd mentality is the delay in tax savings. People wait till the end of the financial year to invest money which leads to poor financial planning. For smooth taxation process and to save one’s taxes, one must take assistance from a financial advisor in order to make better financial decisions and not wait till the last minute.

How to Avoid Herd Instinct?

Herding may be instinctual but there are ways for you to avoid following the crowd, especially if you think you’ll be making a mistake by doing so. It requires some discipline and a few considerations. Try following some of these suggestions:

- Stop looking at others to do the research and take the steps to study the facts for yourself.

- Do your due diligence and then develop your own opinions, ask questions about how and why people are taking certain actions and make your final decision.

- Delay making decisions if you are distracted, whether that’s because of stress or any other external factor.

- Take the initiative, be daring, take assistance of a financial professional before investing and don’t be afraid to stand out from the crowd.

Conclusion: Herd mentality can have both positive and negative consequences. On the positive side, it can help spread good ideas and promote cooperation. However, it can also lead to risky or destructive behaviour, like following a dangerous trend or making rash decisions based on rumours. Hence, it is important to make a rational decision and avoid bias by researching or take help of a financial advisor

Source: Investopedia

Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purposes only and do not construe to be any investment, legal or taxation advice. Please consult your Mutual Fund Distributor before investing. The views expressed are based on the current market scenario and the same is subject to change. There are no guaranteed or assured returns under any of the above-mentioned schemes / fund/ asset class.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.