“Retirement is not the end of the road, it is the beginning of the open highway.” – Anonymous

What is Retirement Planning?

In simple language, retirement planning is about creating a nest egg that will take care of your expenses and ensure your financial stability after you stop working. It’s like setting aside money today so you can enjoy a comfortable and independent tomorrow.

“67% Indians consider themselves ready for retirement” this is likely a half-truth. Here’s a breakdown:

- The Survey Shows Optimism, Not Reality: The 2023 survey suggests more Indians feel prepared for retirement compared to 2020. This is positive, but it doesn’t guarantee everyone has a sufficient plan.

- Contradicting Data: The survey also reveals that over half (52%) expect their children to support them financially, and 28% haven’t even begun saving. This indicates a gap between perception and reality.

- Inadequate Saving: A study reveals that 1 in 3 urban Indians worry about their savings depleting within five years of retirement, and 2 out of 5 individuals haven’t started investing for retirement yet. Most responders believe they have enough family wealth and will be cared for by their children. Also, 9 out of 10 respondents above 50 regret not starting savings earlier for retirement. However, 1 in 2 urban Indians prioritise long-term savings at the start of their career.

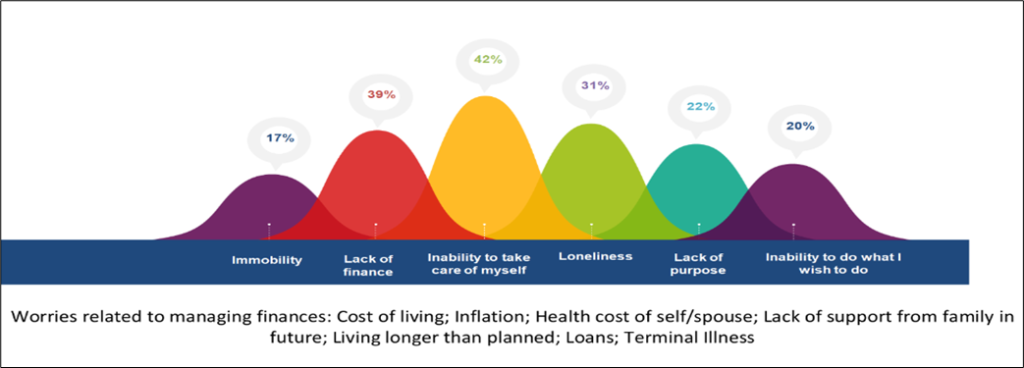

What is your biggest fear post – retirement?

Why is Retirement Planning Important?

There are many reasons why retirement planning is the Need of the Hour…

- Financial Security: You won’t have a regular fixed income after retirement. Planning ensures you have enough money to cover your living costs, healthcare, and other expenses.

- Peace of Mind: Knowing you have a financial cushion reduces stress and allows you to enjoy your retirement years without worry.

- Maintain Your Lifestyle: Retirement planning helps you maintain your desired standard of living after you retire.

- Maintain Independence: Financial security allows you to remain independent and avoid relying on others for financial support.

- Prioritize Retirement Planning: Increasing Life Expectancy with advancements in Medical treatments their related costs and Expenses means adequate funds to be built required for longer post-retirement life.

How to plan for Retirement?

Here’s a basic roadmap to get you started:

- Estimate your retirement needs: Consider your desired lifestyle, potential healthcare costs, and how long you expect to live in retirement.

- Set retirement goals: Based on your needs, determine how much money you’ll need to save.

- Choose investment options: Explore different investment vehicles like retirement accounts, stocks, and bonds that align with your risk tolerance and time horizon.

- Start saving early: The sooner you begin, the more time your money must grow through compound interest.

- Review and adjust: Regularly assess your progress and adjust your plan as needed based on life changes or market fluctuations.

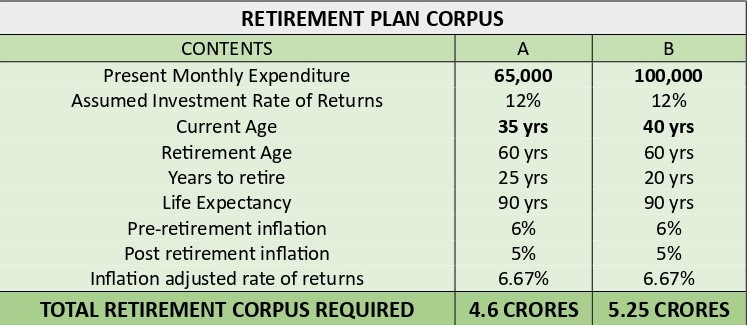

The following tables and illustrations for example, will give an idea on the total retirement corpus that will be required for an uncompromised post-retirement expenditure and lifestyle.

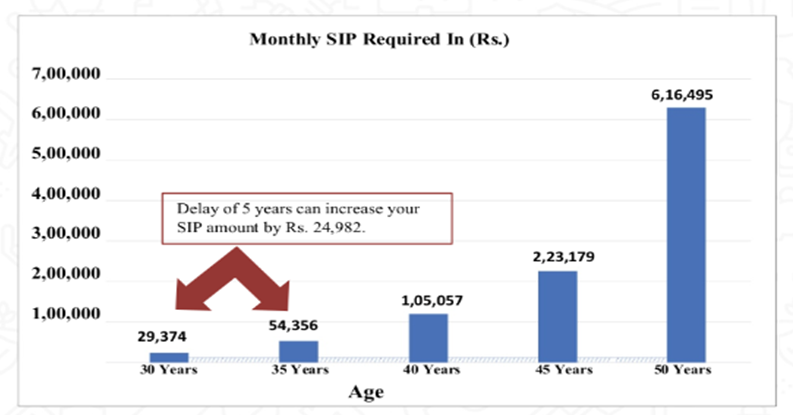

THE COST OF DELAYING RETIREMENT PLANNING:

(The figures mentioned above are hypothetical in nature and shown for illustrative and understanding purpose only and should not be construed as any indication/assurance for future performance in any manner. Mutual Fund schemes do not have a fixed rate of return and it is not possible to predict the rate of return. Recipient should seek advice from financial / tax experts before arriving at any investment decision.)

- If at 30, you estimate Rs. 5 crores as retirement corpus, you need to start a SIP for Rs. 29,374.

- However, if the same is delayed by 5 years and start investing at age 35, you will need to invest Rs. 54,356 per month to accumulate Rs. 5 crores by retirement.

Here is a Case Study of two young 35 year old individual Investors who are planning for retirement…

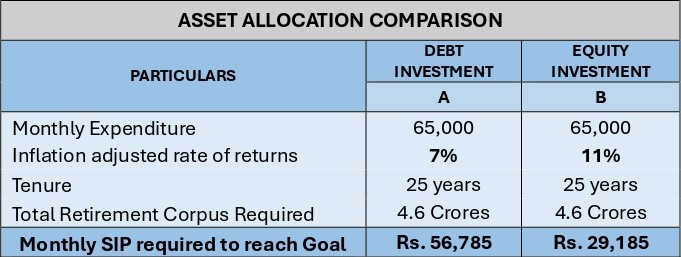

The above table describes two types of investors: Cautious vs. Bold.

- Cautious (Investor A): Puts money in stable investments (debt) with guaranteed but low returns. Inflation eats away at these returns. Needs a higher monthly investment.

- Bold (Investor B): Invests in riskier equity investments with potentially higher returns that can beat inflation. Needs a lower monthly investment.

One Should always consider Inflation before planning for long term goals like Retirement, create wealth sustainability and Prevent wealth erosion due to inflation by correct Asset Allocation.

Key Considerations while investing:

- While execution, the investor needs to plan asset allocation keeping in mind the inflationary risk so that rising inflation doesn’t eat your retirement kitty.

- We often see majority investors prefer to take higher Risk through investment in Equity Mutual fund for short term and expect higher guaranteed returns whereas compromising on compounding returns and wealth creation in long term.

- In the name of Guaranteed returns, the above investor A compromises on wealth creation as well as inflation adjusted return.

- One needs to be more informed about Volatility Risk of Short Term and low interest rate products for Long Term. However, Equity outperformed other asset classes in long term.

- Take enough Health Insurance and Term Plan to safeguard your portfolio from unexpected events.

- Most Investors Undermine their Retirement Corpus: One needs to “factor in lifestyle inflation” while estimating their retirement corpus.

Conclusion: Retirement planning is crucial for a secure and fulfilling future. By starting early, understanding inflation, and choosing the right asset allocation, you can bridge the gap between your current situation and your dream retirement. Remember, this guide provides a general framework, and consulting a financial advisor is recommended for personalized advice.

(Your Stress-Free Retirement is just a Planning away………………………….)

Sources:

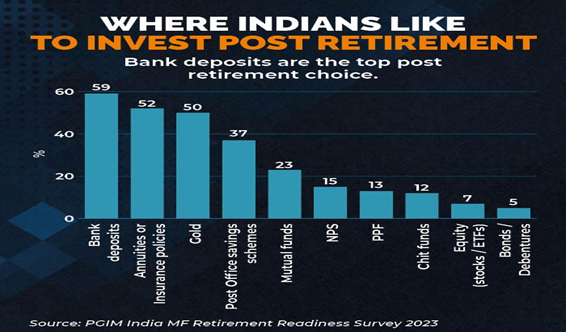

SBI Mutual Fund, PGIM 2023 survey done by PGIM India Mutual Fund with Nielsen IQ, Moneycontrol.com.

Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purposes only and do not construe to be any investment, legal or taxation advice. Please consult your Mutual Fund Distributor before investing. The views expressed are based on the current market scenario and the same is subject to change. There are no guaranteed or assured returns under any of the above-mentioned schemes / fund/ asset class.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.