“The first rule of compounding is to never interrupt it unnecessarily. “- Charlie Munger

Love this quote, understand, and pursue it. We at Goyama FinServ strongly believe this as the core of long-term wealth building cycle and are dedicated to helping our investors towards this very principle. Patience, consistency, and letting the power of compounding work its wonders.

We believe that true wealth creation is not a sprint, but a marathon devoid of the emotional pitfalls of chasing quick returns in the short term. Let us see how the power of Compounding shows its magic but simply following a few ideas.

Key Principles for Sustainable Wealth Growth:

Goal-Based Investing: Aligning your investments with your specific financial objectives is paramount. Short-term needs have different solutions than long-term requirements. Defining your aspirations sets the foundation for a personalized investment strategy.

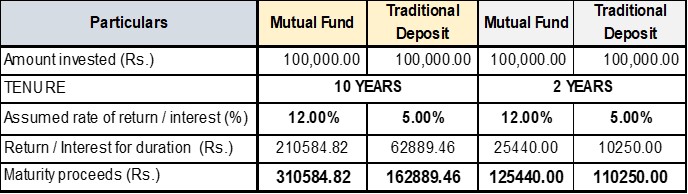

The table aptly demonstrates this phenomenon, showcasing the stark difference in wealth accumulation over 10 years versus 2 years.

Embrace the Power of Time and Stay Invested: Maintaining a disciplined, long-term approach allows you to weather temporary downturns and reap the rewards of recovery.

Case study :

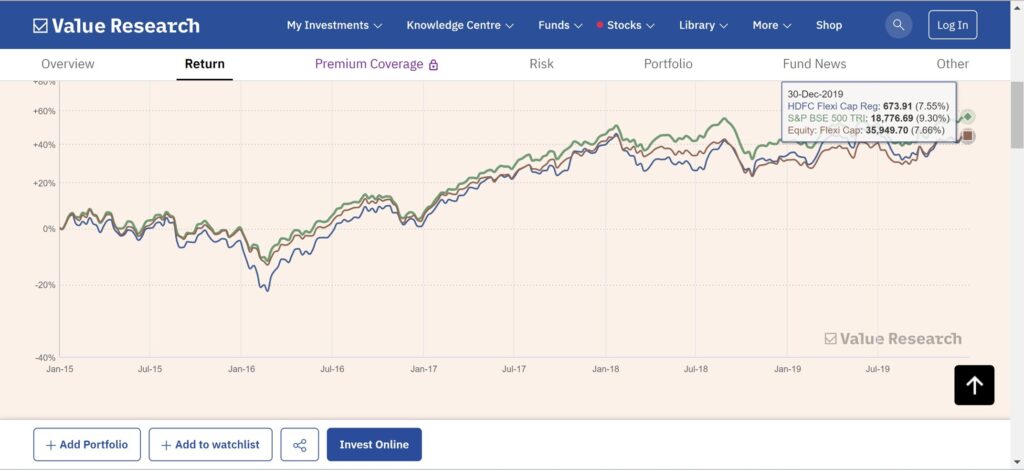

HDFC Flexi cap Fund (one of the oldest funds) with track record of 29 years CAGR 18.87% / or Rs.10,000/- became Rs. 15 lakhs and SIP Return 21% but does this fund always give such return or is this fund always in top performing fund…. The following data will help you to understand:

- This fund within tenure 01.01.2015 to 31.12.2019 not only underperformed benchmark whereas Sensex itself has generated single digit returns in the same.

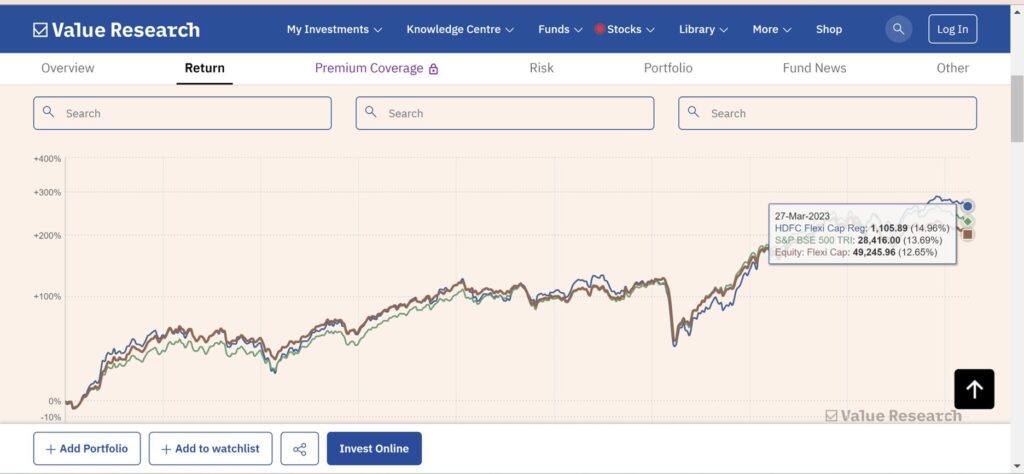

- If the same tenure is extended till 31.03.2023, performance beats the benchmark and has generated double digit returns.

In Last 10 years 3 out of 10 times fund was at bottom rank of performance, one would have missed its top performances which were in 2021 and 2022 due to impatience and not staying invested for longer term.

Not Chasing Performance: Chasing the “best-performing” fund can be a perilous game. Past performance is not indicative of future results, and frequent portfolio changes disrupt the compounding process. Instead, focus on a strategic asset allocation that aligns with your risk tolerance and financial goals.

Tale of Two funds (example): UTI Flexi Cap Fund and HDFC Flexi Cap Fund

- Tenure – 01.01.2015 to 31.12.2020

Returns: UTI Flexi Cap Fund- 12.97%

HDFC Flexi Cap Fund – 7.22%

- Tenure – 01.01.2021 to 20.01.2024

Returns: UTI Flexi Cap Fund- 10.10%

HDFC Flexi Cap Fund – 27 %

Investors evaluating funds based on their short-term performance and chasing such returns tend to lose on the long-term opportunity that the underlying portfolio of the fund has. Therefore, it’s always advisable to allow the fund to grow.

An investor needs to review their Risk profile, goals-based asset allocation for building a long-term sustainable portfolio that can create wealth.

The India Growth Story: Embrace the Long View: India’s promising economic trajectory, projected to become a $30 trillion economy by 2047 along with 61% middle class income group, presents immense opportunities for long-term investors. By capitalizing on this potential and prioritizing stability over short-term noise, you can be part of this exciting journey.

Remember, wealth creation is not a passive endeavor. It requires discipline, patience, and a firm grasp of fundamental investment principles. Goyama FinServ stands with you as you embark on this journey, empowering you with the knowledge and guidance to trust and unlock the magic of compounding and build a secure financial future.

Graph Source: Value research

DISCLAIMER: The above information is purely for knowledge sharing informational purposes only and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any specific purpose or Mutual Fund.

Please consult your Mutual Fund Distributor before investing. The views expressed are based on the current market scenario and the same is subject to change. There are no guaranteed or assured returns under any of the above-mentioned schemes / fund/ asset class.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.